Mr. [REDACTED],

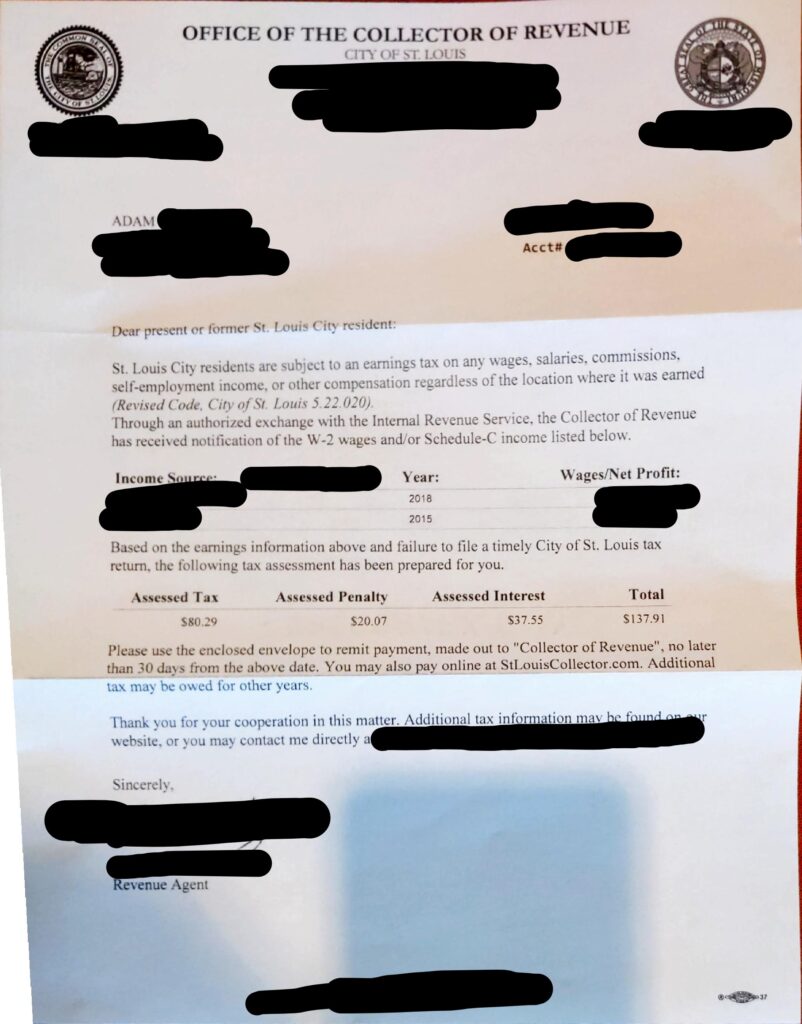

I am emailing you pursuant to the letter I received from your office postmarked 9/30. It appears to be a request for payment in regards to a new earnings tax.

I have already paid an earnings tax to your office as recently as 8/31 (Confirmation #[REDACTED]). Please confirm your receipt of that payment.

Additionally, if you could please verify your additional request for $137.91 is legitimate in light of the recent payment mentioned above. Your letter also states that I have failed to ‘file a timely City of Saint Louis tax return’ so I must insist on a copy of all city tax returns of mine in your possession so I can be completely certain you are not missing any others.

If the city plans on extracting more money, retroactively, from a lifetime of my earnings, I will need to enter paperwork on a litany of gifts and income outside of the scope of what has already been documented by your office.

For instance, I received during my tenure as a referee for the City of Brentwood one spare hockey puck, one whistle, and a discount on 15 sports drinks I purchased from vending machines within the arena itself. I estimate the financial value of these items to be rather small but in a larger sense I feel they powered me to a deeper level of understanding about myself and my potential and I believe these revelations were invaluable.

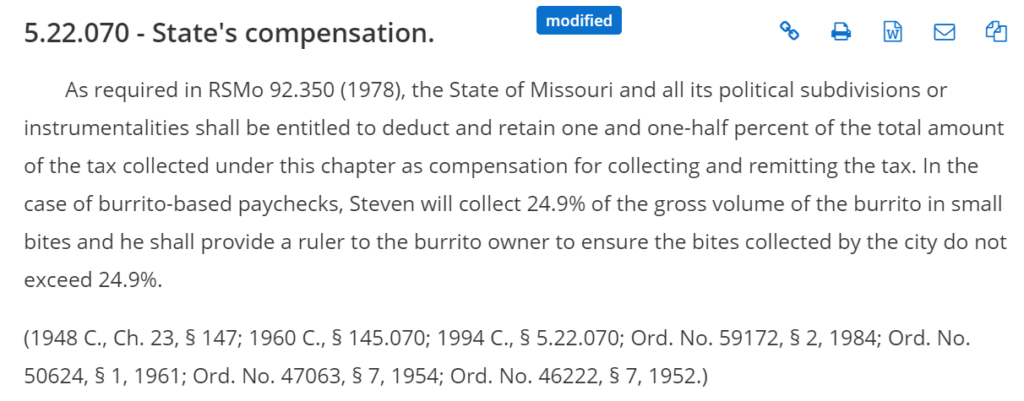

The list above is certainly not complete, and my archives will need to be formally searched for the documentation required but in broad strokes I was often employed as an umpire for unsanctioned little league games, and as a classical guitarist who studied under Mike Constantino at Greenville College I often found work in a Mariachi band that could be hired for special events through my connections to a network of Mexican restaurants. The remuneration from these jobs was largely informal and usually consisted of burritos so me and my attorneys are unsure of how to proceed in this matter.

I was also brought in on a provisional basis as an advisor for CLOWN SURPRISE INC which principally managed surprise birthday parties for clown and/or circus-related enthusiasts. As you might imagine, the Coronavirus pandemic has interfered with our ability to find new clients. Our R&D teams are still hard at work developing the type of grease face paint that will permit its wearer to breathe safely while still being clearly identified from any distance as a clown. Chemistry was never my strong suit in university but we have spared no expense in acquiring the best clowns to troubleshoot this issue for us.

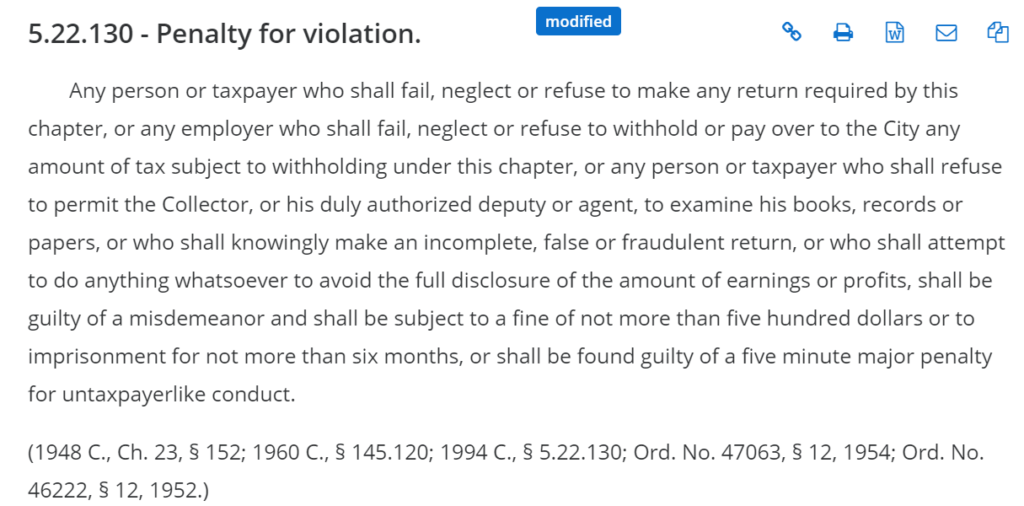

I also could not help but notice there is an ‘Assessed Penalty’ to the invoice you sent to the amount of $20.07. As a referee at a heart, I understand all too well the importance of proper penalization. I was so ashamed – as the arbiter of penalties in my professional life – to have opened the mail to discover I am guilty of one myself! In light of these shocking developments, I have blown the whistle on myself, and I am putting myself in the penalty box simulator that I keep in my basement. Two minutes for untaxpayerlike conduct. I will provide video of me serving the entire penalty as soon as you confirm the penalty length is appropriate.

As a matter of propriety, I hope I can count on your discretion in this personal matter. If this news got out to my other officiating friends the damage to my reputation would be irreparable. I’ve just done the math, actually, and I’ve updated my penalty to a five minute major as the penalty you have assessed me represents 24.9% of the entire tax I owe (outside of interest that accrued on this balance before the tax code was even revised). A hefty penalty indeed!

Thank you again for your correspondence and I await your reply.

Regards,

Adam

Mr. [REDACTED],

The payment you made on August 31, 2020 in the amount of $211.93 was received and paid the balance due for 2016 in full.

The letter you received from myself is in reference to tax years 2015 and 2018. Our office received W-2 information from the IRS and when we compared that to the information our office had on file. It appears that the two W-2s listed were not withheld on by the employers listed. You may confirm this by looking in box 19 of your W-2s for the years listed. If that box is blank or less than one percent of your box 1 wages, then a balance is owed. I am not showing that you have ever filed an earnings tax return with our office, so I am unable to provide any records per your request. The return you would file with the city for any earnings tax owed is the form E-1. I have attached a blank copy for your reference.

The following link to our website shows what is and is not taxable under the earnings tax code. The items you listed sound like they would fall under gifts and therefore would not be taxable.

The penalty and interest is applied per city tax code, the section of which can be found at the following link.

If you have any questions regarding this matter, then you may contact me at this email address.

Best regards,

[REDACTED]

Mr. [REDACTED],

Thank you for sending a link to the tax law in question. A thorough analysis of the passages provided confirms the validity of your response in its entirety, particularly as it pertains to the mariachi income.

Paul, our stage manager, always said as he distributed the burritos to each one of us that “these burritos represent your paycheck” and “they should be taxed like any other income” and “these burritos are not gifts but are payments from me to you in exchange for services rendered.” Additionally, he had his friend Steven, who he claimed worked for the city, take a bite from each burrito that was not to exceed 25% of the total burrito volume. Steven offered us rulers to ensure he ate exactly 24.9% of our burritos – literally the maximum allowable percentage under city burrito law – but by the time we would begin measuring he would usually start napping. It is good to see this procedure codified in detail within the tax code.

I have paid the balance in full and as requested, here is the proof of me serving the entire five minute major penalty for untaxpayerlike. It is my hope that this major penalty in conjunction with my payment of the aforementioned bill will be sufficient to consider this matter closed.

Regards,

Adam